ANIF Subsidiary Invested AMD 700 Million in a Business Owned by Friend of Former Director David Papazian

In 2022, the Entrepreneur + State Anti-Crisis Investments Fund, established two years earlier by the Armenian National Interests Fund (ANIF - a foreign direct investment fund operating under the government of Armenia), invested AMD 700 million in Global Connect CJSC, which belongs to Sergey Grigoryan, a friend of ANIF’s former director David Papazian. The two were also business partners offshore.

This ANIF offshoot invested billions of drams in ten Armenian companies during 2021-2023, simultaneously becoming their shareholders.

AMD 700 million to a friend’s business

In March, April and June 2022, the Entrepreneur+State Anti-Crisis Investments Fund invested a total of 700 million drams, in three tranches, in Yerevan’s Global Connect CJSC (Global Connect). The company, according to Armenia’s State Revenue Committee, is engaged in interstate freight transportation by road.

According to ANIF, the purpose of the investment was the acquisition of eighteen trucks and their semi-trailers (including refrigerated semi-trailers), which was to enable the company to serve large Armenian importers and exporters.

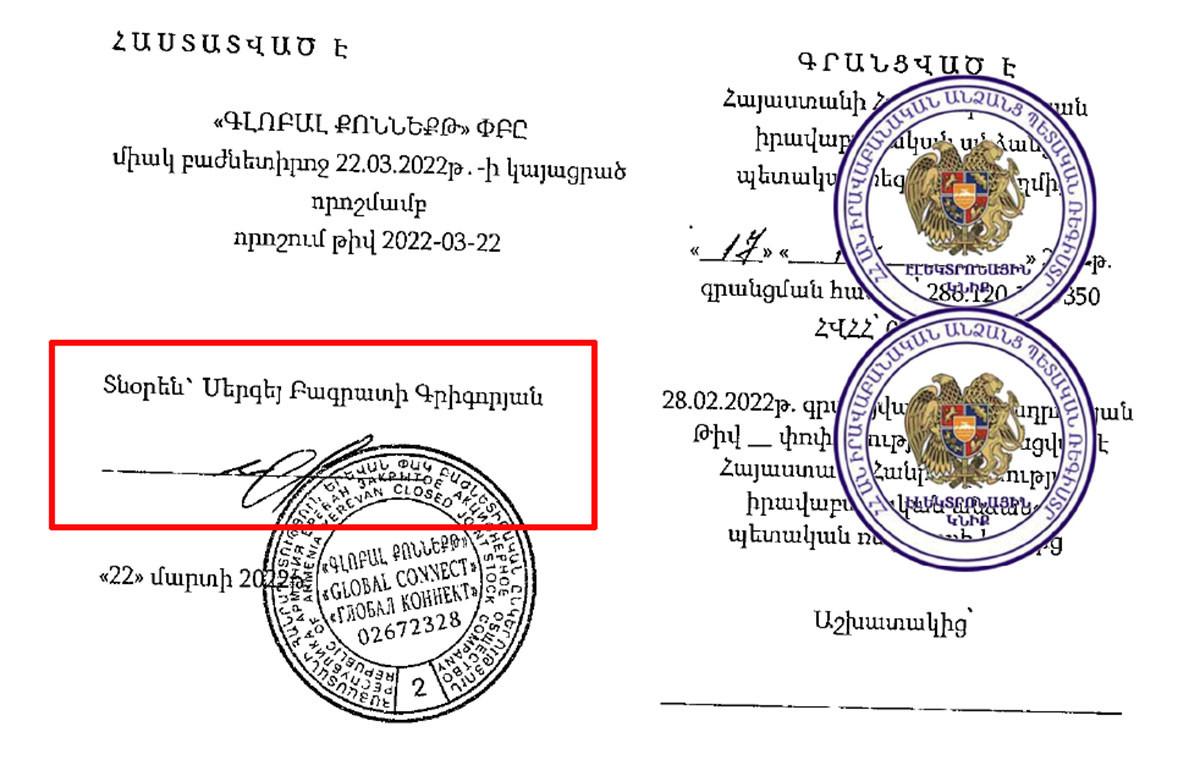

Global Connect LLC was founded in 2018. The sole shareholder was registered as Susanna Gevorgyan from Yerevan, who was also the director, but she was soon replaced as director by her husband, Sergey Bagrat Grigoryan. In December 2021, shortly before receiving an investment from the state fund, the LLC was reorganized into a CJSC (the fund made investments of $0.5-4 million only in joint-stock companies, in return for which it became a shareholder of 25.1-49.9%).

Initially, the Grigoryan-Gevorgyan spouses were 50-50% shareholders in Global Connect CJSC. During the “injection” of 700 million drams into the company in March-June 2022, in the spring, the state fund became a 49% shareholder of the CJSC, the shares of which are managed by Entrepreneur+State Anti-Crisis Investment Manager CJSC (director: Bella Manoukian). The owner of the remaining 51% is Susanna Gevorgyan.

If the state fund received 49% of the shares in exchange for an investment of 700 million drams, then it turns out that the investment of 51% owner Susanna Gevorgyan (or rather, the spouses) in the CJSC was also valued at approximately the same or slightly more. On the other hand, a source for Hetq reported that before investing in Global Connect from state funds, the company had only five trucks. Naturally, the value of a company is not determined solely by the amount of assets it has, but questions still arise about the assessment made by ANIF and the decision on the amount of investment.

Sergey Grigoryan, in the summer of 2022, said the reason for turning to ANIF was that their trucks were not sufficient to fulfill customer orders. Thus, they also used trucks from other Armenian and foreign companies and later decided to increase their own fleet.

Hetq learned from ANIF current management that Global Connect ultimately acquired seventeen trucks thanks to investments from the state fund.

Three of the acquired trucks (ANIF's FB page)

In 2022, the director of ANIF, the parent of the Entrepreneur+State Anti-Crisis Investments Fund, was David Papazian, and Tigran Avinyan, chairman of the board of directors. (Avinyan is now Yerevan’s mayor.)

In February 2024, the Hraparak daily, citing former ANIF employees, wrote that Sergey Grigoryan, the director of Global Connect, is a close friend of David Papazian.

In May of this year, Armenian Prosecutor General Anna Vardapetyan, referring to the preliminary investigation into the criminal proceedings related to ANIF conducted by the Investigative Committee, announced that episodes of abuses committed during the joint activities of it and a number of companies, including Global Connect, are being investigated.

Hetq asked Vardapetyan what information law enforcement agencies have about the close friendship between David Papazian and Sergey Grigoryan, and whether evidence was obtained during the preliminary investigation showing that this connection played a role in the AMD 700 million investment in Global Connect. The prosecutor's office merely replied that the preliminary investigation was ongoing but did not answer other questions.

Hetq found evidence that Grigoryan and Papazian were also partners, and that their business interests intersected in the offshore British Virgin Islands (BVI).

The offshore dealings of Papazian and Grigoryan

Hetq found evidence of the business connection between David Papazian and Sergey Grigoryan in the Pandora Papers, which contain data leaked from offshore zones on more than 27,000 companies and about 30,000 owners of them.

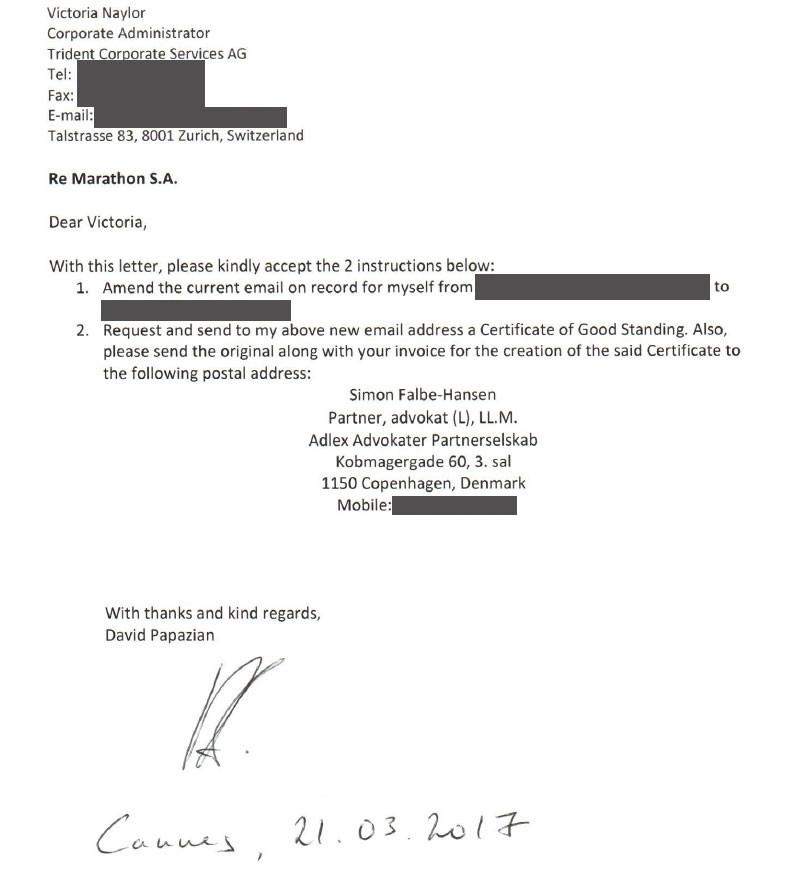

The data was leaked from fourteen companies providing services in offshore zones. These are intermediary or agent organizations that help their clients establish and manage shell companies for various purposes in offshore tax havens. One of these fourteen is Trident Trust Group, which has branches in various countries, including the British Virgin Islands (BVI).

The offshore companies related to Papazian and Grigoryan were established in the BVI and were serviced by Trident Trust.

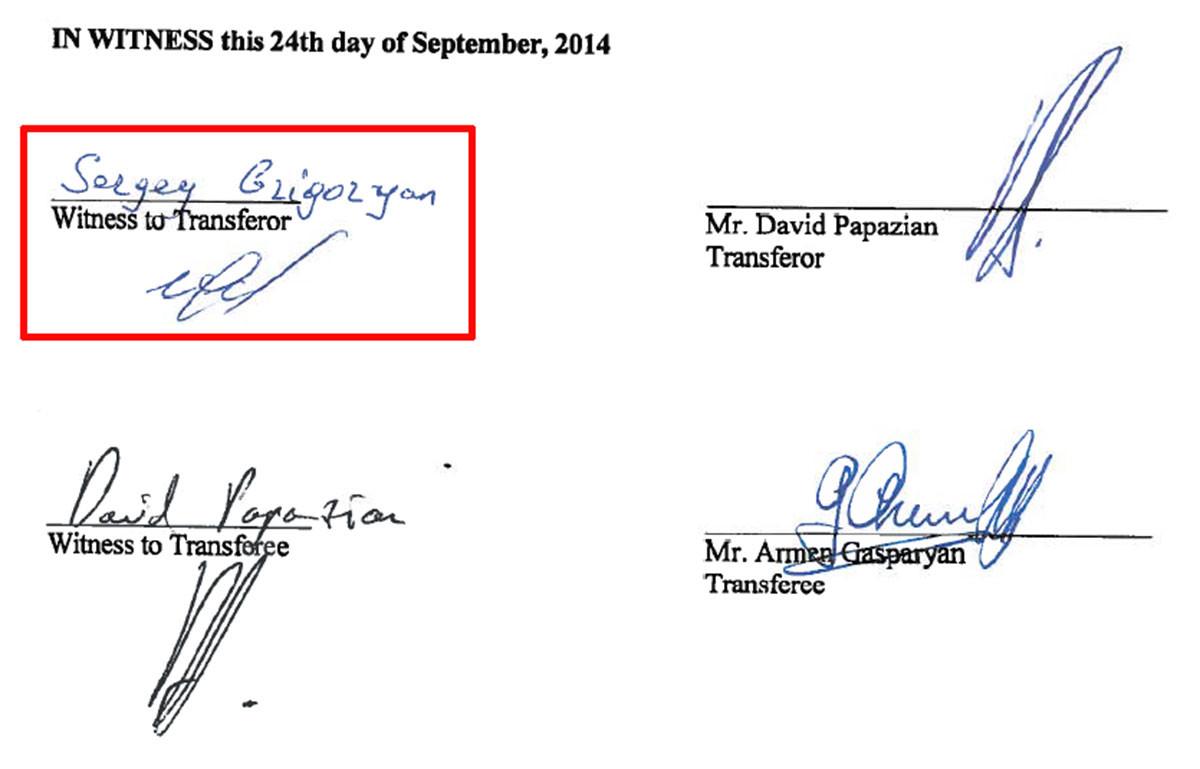

According to the leaked documents, which Hetq has been studying with its international partners since 2021, Davit Papazian was a 50% owner of Tommy Invest & Finance Corp., a company established in 2008, between 2009 and 2014. In September 2014, Papazian transferred his share to his partner, Armen Gasparyan, who became the sole owner. (Both are listed in the documents with Moscow addresses).

In one of the documents, Sergey Grigoryan served as a witness to the transfer of the share by David Papazian, for which he signed. This signature coincides with the signature of Sergey Grigoryan, the director of Global Connect CJSC, which means that we are talking about the same person (see below).

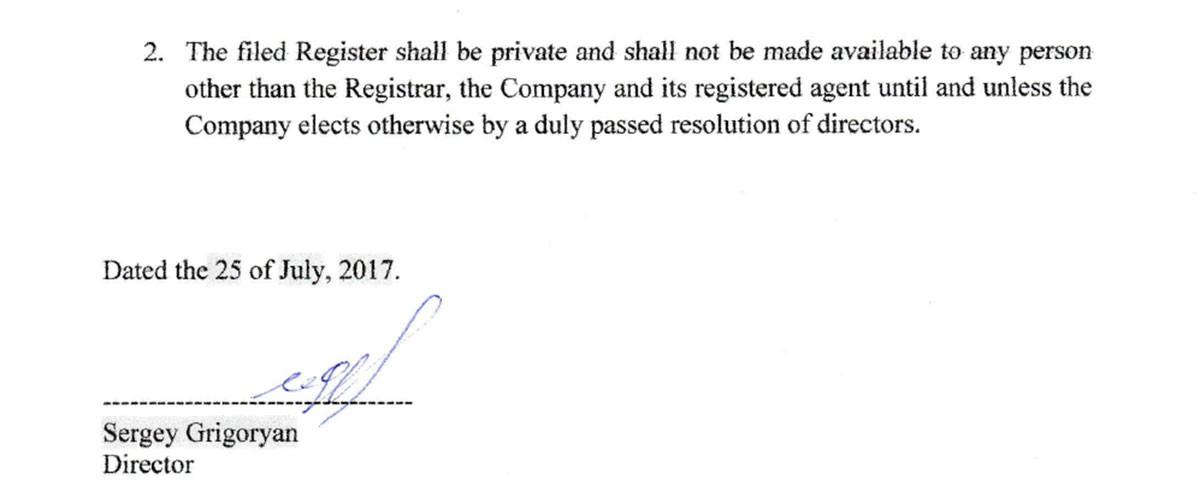

The Papazian/Grigoryan offshore business connection is evident in the Marathon S.A. company founded in the BVI. According to the Pandora Papers, Grigoryan was a director here (see below). The fact that the latter and the director of Global Connect CJSC are the same person is proven by both the signatures, the Yerevan address, and the birth data.

The fact that David Papazian was the owner of Marathon S.A. is evidenced in the leaked documents. He gave instructions to Trident Trust on the management of the company (see below).

We don’t know whether the offshore cooperation between the two friends continues to this day. Hetq sent inquiries to Grigoryan and Papazian's personal e-mails, as well as to the official e-mail of the Global Connect, requesting that they comment on the issue. More than a week has passed and we’re still waiting.

Global Connect was not the only acquaintance of the former ANIF leadership

Hetq has written that CFW CJSC, one of the companies that received investments from the Entrepreneur+State Anti-Crisis Investments Fund, is related to Tigran Avinyan, the current mayor of Yerevan and the then chairman of the ANIF board of directors.

CFW received AMD1.5 billion (US$3.8 million today) just eight days after it was created. CFW Director Karineh Andreasyan is a close friend and business partner of Avinyan’s wife.

Armenia’s Prosecutor General's Office has initiated criminal proceedings against former ANIF director Davit Papazian, Karineh Andreasyan, and Bella Manoukian, former director of Entrepreneur+State Anti-Crisis Investment Manager CJSC, under several articles of the Criminal Code, including money laundering.

Armenia will issue an international arrest warrant for Davit Papazian, a ban on leaving the country has been imposed on Andreasyan, and pre-trial bail has been levied on Manoukian.

A month after CFW, in June 2023, Universal Closures CJSC received an investment of some AMD 1.7 billion from the Entrepreneur+State Anti-Crisis Investments Fund. The beneficial owners of this, as Hetq wrote, are well-known representatives of the Armenian banking sector.

In 2023, the fund made another large investment. This time, AMD 960 million were invested in two tranches in Berrymount CJSC, which, according to Radio Liberty, belongs to Tigran Avinyan’s classmate Dmitry Alekseyenko. At the time, Avinyan was still the chairman of the ANIF board of directors.

Between January and June 2023, the Entrepreneur+State Anti-Crisis Investments Fund invested AMD 4.2 billion (US$11 million at the current exchange rate) in three companies that belong to Tigran Avinyan's entourage or not-so-random representatives of the banking sector.

Government has put companies that received investments in a dilemma

On August 28 of this year, the Armenian government decided to start the process of recovering the investments made by the Entrepreneur+State Anti-Crisis Investments Fund. The decision concerns the fund manager, Entrepreneur+State Anti-Crisis Investments Manager CJSC, whose owner was ANIF from 2019-2024, and from 2024 to the present day, the State Property Management Committee (SPMC).

Thus, on August 28, the government allowed the state fund manager to alienate the shares received in return for the fund’s investments in private companies. The alienation price was calculated as follows: the invested amount + 10.27% of it for each year.

As mentioned, Global Connect received the AMD 700 million investment in three tranches in March, April, and June 2022: 350 million + 300 million + 50 million. The government has calculated AMD 269 million of interest on them until December 31, 2025. As a result, the executive branch wants to alienate the 49% shares acquired by the fund for 700 million drams for about 921 million drams (700-million-dram investment + 269 million drams of interest - 48 million drams of dividends previously paid to the fund).

The fund manager must send proposals to the other shareholders of the companies (private partners) that received the investment by October 1 of this year to acquire the shares belonging to the state fund by March 31, 2026. In other words, the government wants to get rid of the fund's (in other words, its own) shares in private companies by the end of March next year.

The recipients of the proposal can give their written consent by December 30 of this year. The agreement can be in two forms: either the private partners acquiring the fund’s shares must make an advance payment in the amount of the investment received (in the case of Global Connect, 700 million drams), and pay the remaining amount by March 31 of next year, or they must take out a budget loan with a repayment period of up to ten years, for which, however, it is necessary to submit a bank guarantee (in the case of Global Connect, this guarantee was calculated at about 1 billion drams).

Can Sergey Grigoryan and his wife Susanna Gevorgyan return 921 million drams to the state by March 31, 2026 or fall under the burden of a budget loan? Let's note that according to the government's decision, the fund manager will only submit proposals for the alienation of shares, that is, it is not clear what will happen if the private partners do not want to acquire them and refuse to go to the deal.

The government, however, has dangled a "sword of Damocles" over their heads, which the owners of the companies that received investments know very well. We are talking about criminal proceedings related to ANIF, in which the names of numerous companies are touched upon, including those that received AMD millions or billions from the Entrepreneur + State Anti-Crisis Investments Fund. As mentioned above, the name of Global Connect is also mentioned in the criminal proceedings.

When discussing the above-mentioned draft government decision in August, the Ministry of Territorial Administration and Infrastructure (the State Property Management Committee, which is superior to the state fund manager, in turn reports to the Ministry of Territorial Administration and Infrastructure - MTAI) reported that during the development of the project, separate discussions were organized with all private partners.

Four of them, including Global Connect CJSC, presented their proposals for the purchase of shares in the fund, which, however, according to the MTAI, differed significantly from the terms of the shareholder agreements based on which the fund had previously invested in these companies.

According to the MTAI, the proposals of the private partners mainly assumed a return in installments of the amount of funds invested by the fund (in some cases, slightly more) over a period of up to five years. Thus, the owners of these four companies offered the state to return the fund's investments within five years or a little more (there is no mention of interest), but they were rejected.

Now, they are faced with a serious choice: either agree to one of the two options proposed by the government, or not go through with the deal and, in essence, become a "thorn in the side" of the state system, with all the consequences.

Top photo: David Papazian

Videos

Videos Photos

Photos

Write a comment